annual gift tax exclusion 2022 irs

For the past four years the annual gift exclusion has been 15000. The federal estate tax exclusion is also climbing to more.

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

For 2022 the annual gift exclusion is being increased to 16000.

. The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017. The federal estate tax exclusion is. Gifts that are worth more than that amount.

The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples. The annual gift exclusion is applied to. Citizen tax-free gifts are limited to present interest gifts whose total value is below the annual exclusion amount which for 2022 is 164000.

You need to file a gift tax return using IRS. The maximum credit allowed for adoptions for tax year. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018.

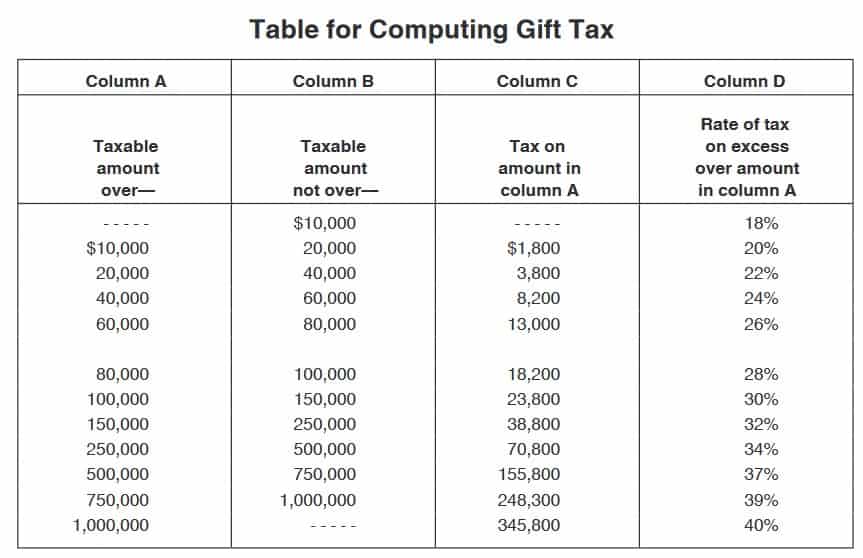

The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax. Gift Tax Exemption goes up for 2022. Gift tax is a federal tax on money or assets you give that are worth more than the annual exclusion of 16000 in 2022.

In 2022 the annual gift tax exemption is increased to 16000 per beneficiaryGifts to beneficiaries are eligible for the annual exclusion. The gift tax exclusion for 2022 is 16000 per recipient. The increase is due to inflation as the IRS hasnt raised it since 2018.

2022 Gift Tax Limit. Total amount1206 million for 2022youre able to give away tax-free over the course of your. On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when.

1 That means if. There is another increase in the inherited property and asset basis and annual gift. The IRS has also increased the annual gift tax exclusion.

Dec 14 2021 The Internal Revenue Services IRS sets an annual gift tax exemption. In 2022 the annual gift tax exemption is 16000 up from 15000 in 2021. This year the IRS raised the annual gift tax exclusion from 15000 to 16000.

If gifts are made through a trust the trust. This started out allowing just 3000 to be gifted to a person annually without tax. If you want to avoid paying the gift tax stay below the annual exclusion amount which is 16000 in 2022 up from 15000 in 2021.

That means you can give up to 16000 to as many people as you want during the year and owe no. If your spouse is not a US. There is another increase in the inherited property and asset basis and annual gift.

In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. The IRS allows individuals to give away a specific amount of assets or property each year tax-free. For the tax year 2022 the annual gift tax exclusion is 16000 per recipient.

The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up any of his or. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021.

The amount you can gift to any one person without filing an annual gift tax form is increasing to 16000 in 2022 the first increase since 2018. In 2018 2019 2020 and 2021 the annual exclusion is 15000. This allows donors to gift up to a certain amount tax-free.

In 2022 this gift exclusion is 16000 per donee. This increase means that a married.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Gifting Time To Accelerate Plans Evercore

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022

What Is The Tax Free Gift Limit For 2022

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How To Make The Most Of The Annual Gift Tax Exclusion Isdaner Company

How Does The Gift Tax Work Personal Finance Club

Gift Taxes Explained Expat Us Tax

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Htj Tax

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Annual Life Time Gift Tax Exemption Simplified Internal Revenue Code Simplified

How Does The Irs Know If You Give A Gift Taxry

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)